For this article, we obtained a Mondaq Top Communicator Award for December 2015.

Cyprus now provides high-net-worth individuals (HNWIs) with (further) incentives to relocate to Cyprus.

This is one of the objectives of the introduction of the non-domicile rules (voted on the 9th of July 2015, among other tax reforms) that came into force on the 17th of July 2015 (date of the publication in the Official Gazette of the Republic of Cyprus).

What is the concept of domicile?

Previously, a distinction was made between non tax residents and tax residents:

- Non tax residents were entitled to most of the tax advantages the Cyprus tax regime had to offer.

- However, tax residents had to pay taxes on all of their worldwide income, including Special Defence Contribution Tax (17% on their dividends, 30% on the interest they earned and 3% on 75% of their rental income), in Cyprus.

In order to give additional incentives to high-net-worth individuals to relocate to Cyprus or to continue carrying out their business operations or investments from the Republic, the Government introduced the concept of domicile (or the non-dom rules) for the purposes of the Special Defence Contribution Tax Law.

As a result an individual may be resident, but not domiciled in Cyprus.

Please note that tax residents that are not domiciled in Cyprus are exempted from the Special Defence Contribution Tax.

The concept of “domicile” pre-existed in the Cypriot legislation, in the Wills and Succession Law, where it was used to determine which jurisdiction should govern the succession of a deceased person.

Please note that:

- The concept of domicile is distinct from the concept of residence, nationality or citizenship.

- A person must have one (and only one) domicile at any given time.

In the law a distinction is made between “domicile of origin” and “domicile of choice”.

- Domicile of origin is acquired at birth.

- Domicile of choice is retained by the individual who intends to live permanently and/or indefinitely in one particular place.

According to the relevant law, a person is deemed domiciled in Cyprus

- by virtue of having been tax resident in Cyprus for 17 of the last 20 years prior to the relevant tax year independently of his/her domicile of origin.

- by virtue of the fact that his/her domicile of origin is in Cyprus, unless:

- the person has acquired domicile of choice in another country, provided that he/she has not been tax resident in Cyprus for a period of 20 consecutive years prior to the relevant tax year.

- the person has not been tax resident in Cyprus for a period of 20 consecutive years prior to the introduction of the law, which came into force on the 17th of July 2015.

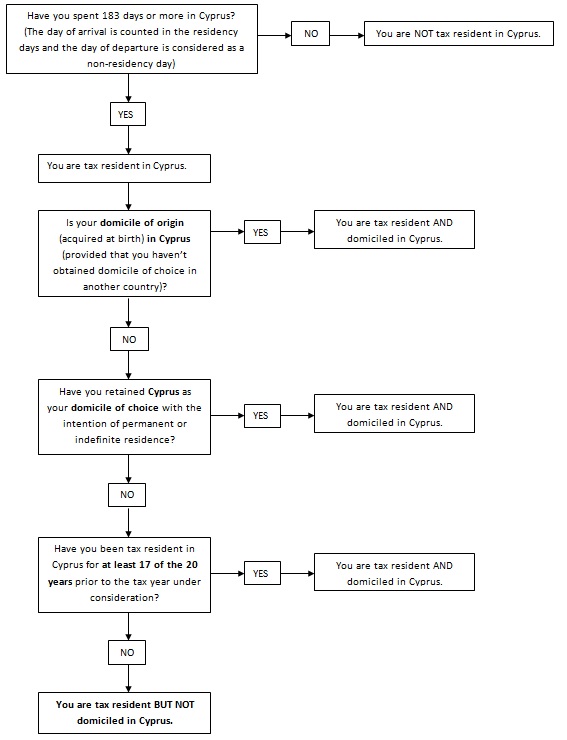

How can you determine what your tax residency and domicile status is?

You can do so, by replying to the following questions or by following the flow chart:

Tax Residency

- In total, how many days have you spent during a particular calendar year in Cyprus? (Please note that the day of arrival is counted in the residency days and the day of departure is counted in the non-residency period)

- If the number is equal to 183 days or more, then you are tax resident in Cyprus.

Domicile

- What is your domicile of origin (acquired at birth)?

- Have you acquired domicile of choice in Cyprus?

- Have you been tax resident in the Republic for 17 of the last 20 tax years prior to the relevant tax year?

If your answer to all three questions is no, then you are not domiciled in Cyprus.

In order to determine your tax residency and domicile status for a particular tax year, check out the following flow chart:

The above information is provided for general purposes only and does not constitute legal or other advice.

For tax planning advice, you can get in touch with our lawyers and consultants.

An edited version of this article has been published by the International Law Office.