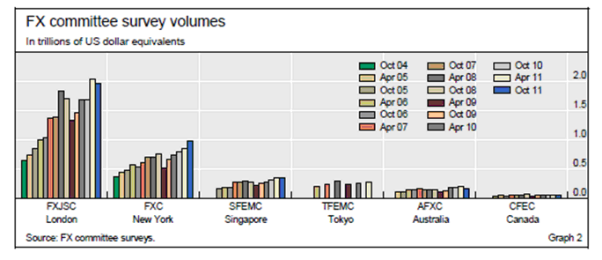

According to 2012 FX Committee survey volumes, it is estimated that since 2004 the global foreign exchange market turnover (trading volume) has doubled and currently stands at approximately 4 Trillion US Dollars being traded on average daily*. This is around 20 times the daily trading volume of NYSE and Nasdaq together.

Even more impressive are the statistics concerning retail investors who trade in FX online through electronic trading platforms. The growth of electronic execution methods and the diverse selection of execution venues have lowered transaction costs, increased market liquidity, and attracted greater participation from many customer types. In particular, electronic trading via online portals has made it easier for retail traders to trade in the foreign exchange market. In 2010, retail trading was estimated to account for up to 10% of spot FX turnover, or $150 billion per day Retail FX daily volume.

Below graph shows the level of activity across the different markets and time:

* The $4 trillion break-down is as follows:

- $1.490 trillion in FX spot transactions

- $475 billion in outright forwards

- $1.765 trillion in foreign exchange swaps

- $43 billion currency swaps

- $207 billion in FX options and other products